In the era of digital transformation, peer-to-peer (P2P) payment apps have emerged as a dominant force in the financial technology landscape. From sending money to friends and splitting bills to paying for services, P2P apps like Venmo, Cash App, Zelle, and PayPal have revolutionized the way we handle everyday transactions.

If you’re considering launching your own P2P payment app, one of the most critical factors to evaluate is the P2P payment app development cost. In this article, we’ll explore what drives the cost of developing a P2P payment app, what features are essential, and why partnering with the right development team like Attract Group can make all the difference.

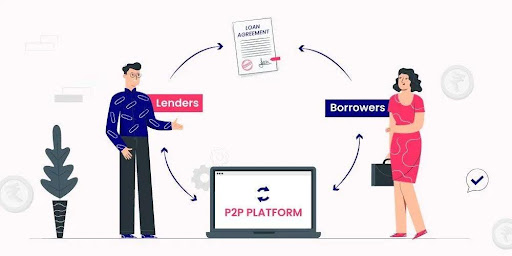

What Is a P2P Payment App?

A P2P payment app allows users to transfer money from one bank account to another using a mobile application, without involving a physical bank. These transactions are usually facilitated via bank transfers, credit/debit cards, or digital wallets.

These apps offer:

- Real-time money transfers

- Low to zero transaction fees

- Multi-currency support

- Easy integration with bank accounts

The growing demand for contactless, quick, and secure money transfers is pushing more businesses and entrepreneurs to enter this market.

Key Features of a P2P Payment App

Before we dive into the P2P payment app development cost, it’s important to understand the core features that any successful app must have:

1. User Registration & Profile Management

This includes user sign-up via email, phone number, or social media accounts, along with KYC verification.

2. Bank Account Linking

Secure integration with bank APIs to enable users to link their credit/debit cards or bank accounts.

3. Send & Receive Money

A user-friendly interface that allows for smooth and secure transfers between users.

4. Transaction History

A detailed and searchable log of all past transactions.

5. Push Notifications

Real-time alerts for successful or failed transactions, security updates, or promotions.

6. Security Features

Multi-factor authentication, biometric login, data encryption, and fraud detection are non-negotiables.

7. Currency Conversion (Optional)

If targeting international users, currency conversion with real-time exchange rates can be added.

8. Chat or Notes

Allowing users to include a short message or note with their transaction.

9. Admin Panel

For managing users, resolving disputes, generating reports, and monitoring app performance.

Factors Influencing P2P Payment App Development Cost

The total P2P payment app development cost varies based on a wide array of factors. Here are the most impactful ones:

1. Platform Choice (iOS, Android, or Both)

- Single Platform (iOS or Android): $30,000 – $60,000

- Cross-Platform: $50,000 – $100,000

Building apps for both platforms increases the development time and cost, though cross-platform frameworks like Flutter can offer cost-effective alternatives.

2. App Complexity

- Basic App with Essential Features: $30,000 – $50,000

- Moderately Complex App (with multi-currency, wallet features): $50,000 – $100,000

- Highly Advanced App (with AI, analytics, blockchain): $100,000 – $200,000+

3. UI/UX Design

Intuitive and clean design is essential for user retention. The cost can vary from $5,000 to $20,000 depending on the number of screens and complexity of interactions.

4. Backend Development

The backend handles all server-side operations like storing data, processing payments, and user authentication. Costs range from $10,000 to $50,000+ based on the architecture and scalability.

5. Third-party Integrations

- Payment gateways (Stripe, PayPal, etc.)

- KYC/AML verification APIs

- SMS/email service providers

- Cloud storage (AWS, Azure)

Integration can cost between $5,000 and $20,000.

6. Security & Compliance

Security is paramount for a fintech app. Additional investment is required for:

- End-to-end encryption

- PCI-DSS compliance

- GDPR/CCPA compliance

- Biometric authentication

Security costs can range from $10,000 to $50,000.

7. Maintenance & Updates

Post-launch support is necessary for fixing bugs, adding features, and ensuring compliance. Yearly maintenance typically costs 15–20% of the initial development cost.

Total Estimated Cost of P2P Payment App Development

Here’s a summarized breakdown:

| Component | Estimated Cost Range |

| UI/UX Design | $5,000 – $20,000 |

| Frontend & Backend Development | $30,000 – $100,000+ |

| Security & Compliance | $10,000 – $50,000 |

| Third-Party Integrations | $5,000 – $20,000 |

| QA & Testing | $5,000 – $15,000 |

| Project Management | $5,000 – $10,000 |

| Total | $60,000 – $200,000+ |

Note: These costs are indicative and may vary depending on location, team size, and project scope.

Why Choose Attract Group for Your P2P App Development?

If you want a trusted partner to handle your project from concept to launch, Attract Group is a top choice.

What Sets Attract Group Apart?

✅ Fintech Expertise

Attract Group has a proven track record in building secure and scalable fintech applications. They understand the complexities of P2P systems, including legal compliance and user experience best practices.

✅ Custom Development

They don’t believe in one-size-fits-all solutions. Attract Group crafts tailor-made applications to match your vision, goals, and target audience.

✅ Agile Methodology

Their agile approach ensures transparency, continuous feedback, and adaptability—ideal for startups and growing businesses.

✅ End-to-End Services

From market research and UI/UX design to development, deployment, and post-launch support, they handle it all.

✅ Cost-Effective Solutions

Located in Eastern Europe, Attract Group offers high-quality development services at competitive rates, significantly reducing your overall P2P payment app development cost.

How to Reduce Development Costs Without Sacrificing Quality

Here are some tips to optimize your development budget:

1. Start with MVP

Begin with a Minimum Viable Product to validate your concept. You can always add more features later.

2. Use Cross-Platform Development

Leverage frameworks like Flutter or React Native to build for both iOS and Android at once.

3. Choose the Right Team

Partnering with experienced developers like Attract Group can prevent costly mistakes and reduce development time.

4. Avoid Feature Overload

Focus on features that deliver core value. Fancy add-ons can wait.

5. Plan for Scalability

Design your architecture to scale easily. It might cost a bit more upfront but will save thousands later.

Final Thoughts

Developing a P2P payment app in 2025 is a significant but highly rewarding investment. The P2P payment app development cost can range from $60,000 to over $200,000 depending on the scope, technology stack, and business model. Understanding the cost drivers and planning your budget accordingly is key to building a successful application.

If you’re looking for a reliable development partner with fintech expertise, consider working with Attract Group. Their comprehensive services, technical proficiency, and customer-first approach make them an excellent choice for launching a feature-rich and secure P2P payment app.